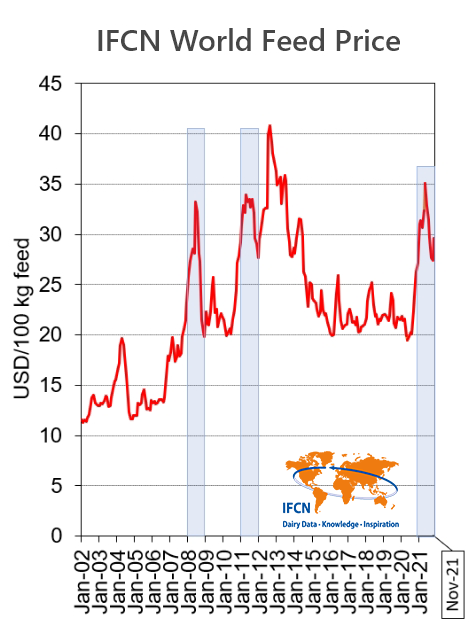

Dairy farmers have faced rising input costs since the end of 2020. Based on an analysis of typical farm types in more than 50 countries, IFCN finds that the main cost item, accounting for 30% to 70% of the cost of milk production, is precisely feed. And if you mention feed prices to a farmer these days, you can only give him a headache.

But what is driving up feed prices?

There are probably several reasons why feed prices continue to rise: tight stocks, less than rosy harvest forecasts from Latin America, firm demand, etc. Then there is the rise in production costs, supported by increases in energy and fertilizer prices.

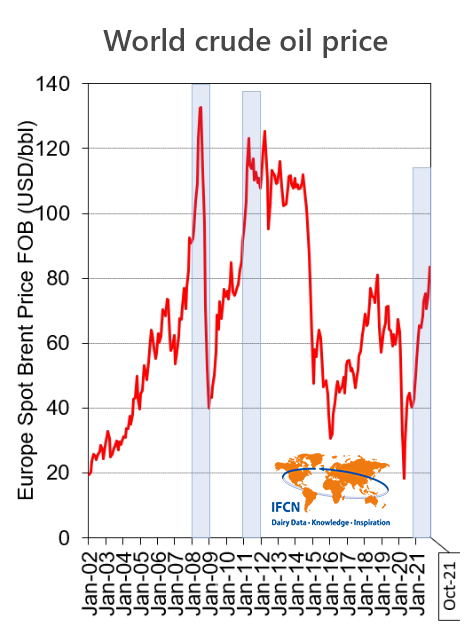

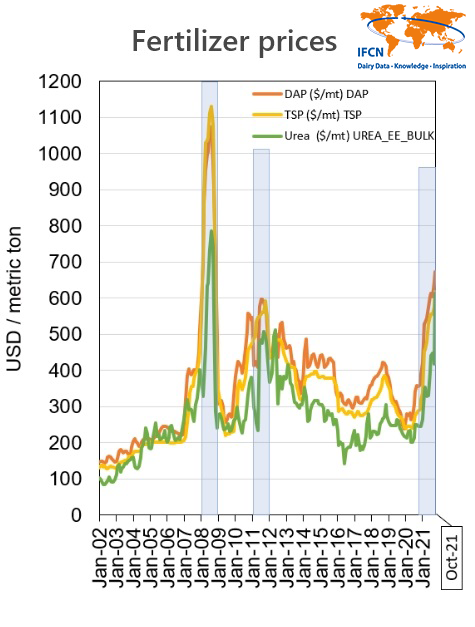

Over the last 20 years, we have seen a clear correlation between world oil prices, fertilizer prices and feed prices. During this period, we have seen some peaks in prices: 2008, 2011, and now 2021, with prices for major phosphorus and nitrogen fertilizers more than doubling in 2021 compared to the previous year. The main reason is the increase in oil prices, as this is an energy-intensive industry. Some companies even reported a decrease in production because they cannot manage their own production costs.

What does this mean for dairy farmers?

Dairy farmers are going to continue facing high feed prices. This includes costs for purchased feed, but also production costs for homegrown, strongly depending on the country and farming system. Detailed description and analysis about typical farm costs is available in the latest IFCN Dairy Report and Farm Economics Database.

Critically, high fertilizer prices may now impact milk production over a longer period. Already in the second half of 2021, milk production growth has flattened compared to the previous year. High fertilizer and oil prices will directly impact upcoming spring field work and feed production costs. The questionable availability of fertilizers on the market may affect crop yield, but also feed quality.

What does this imply for the dairy sector?

The dairy sector has some special characteristics that result in the fact that milk production cannot be ramped up or stopped immediately, depending on market developments. The aforementioned decrease in milk production growth in 2021, was already due to the increase in feed prices. If fertilizer prices hit feed production this spring, the negative impact on milk production will likely still be felt in 2023. IFCN will monitor the impact on milk supply and milk prices for 65 countries each month and discuss the possible scenarios with its network.

IFCN past events

IFCN Dairy Processors, People, Profit, Planet Conference 2021

IFCN Dairy Forum 2021

IFCN Supporter Conference 2021

IFCN Online Dairy Conference 2021