This article is based on the IFCN Dairy Report 2023

Key insights

In terms of global milk production, 2022 brought an extraordinarily low milk supply growth of 0.8%. Major driver for this was a declining supply in exporter regions like EU-27 and New Zealand but also a comparatively moderate growth of the Indian dairy sector.

Demand for dairy products developed equally moderately by +0.8% as milk demand per capita even declined by –0.2% at the global level.

World trade declined for the first time since 2006 due to continued supply chain disruptions and lower import demand from China.

Farm profitability overall was very good, as the increases in costs were smaller than the upturn in world milk price, which increased by 18% to a record 53 USD/100 kg standardised milk in 2022.

IFCN monitors global milk production on an annual and monthly basis including real-time estimates to provide one of the fastest market updates available, which is crucial to understand the milk price development. The Dairy Report comprises detailed information about key dairy indicators for 125 countries.

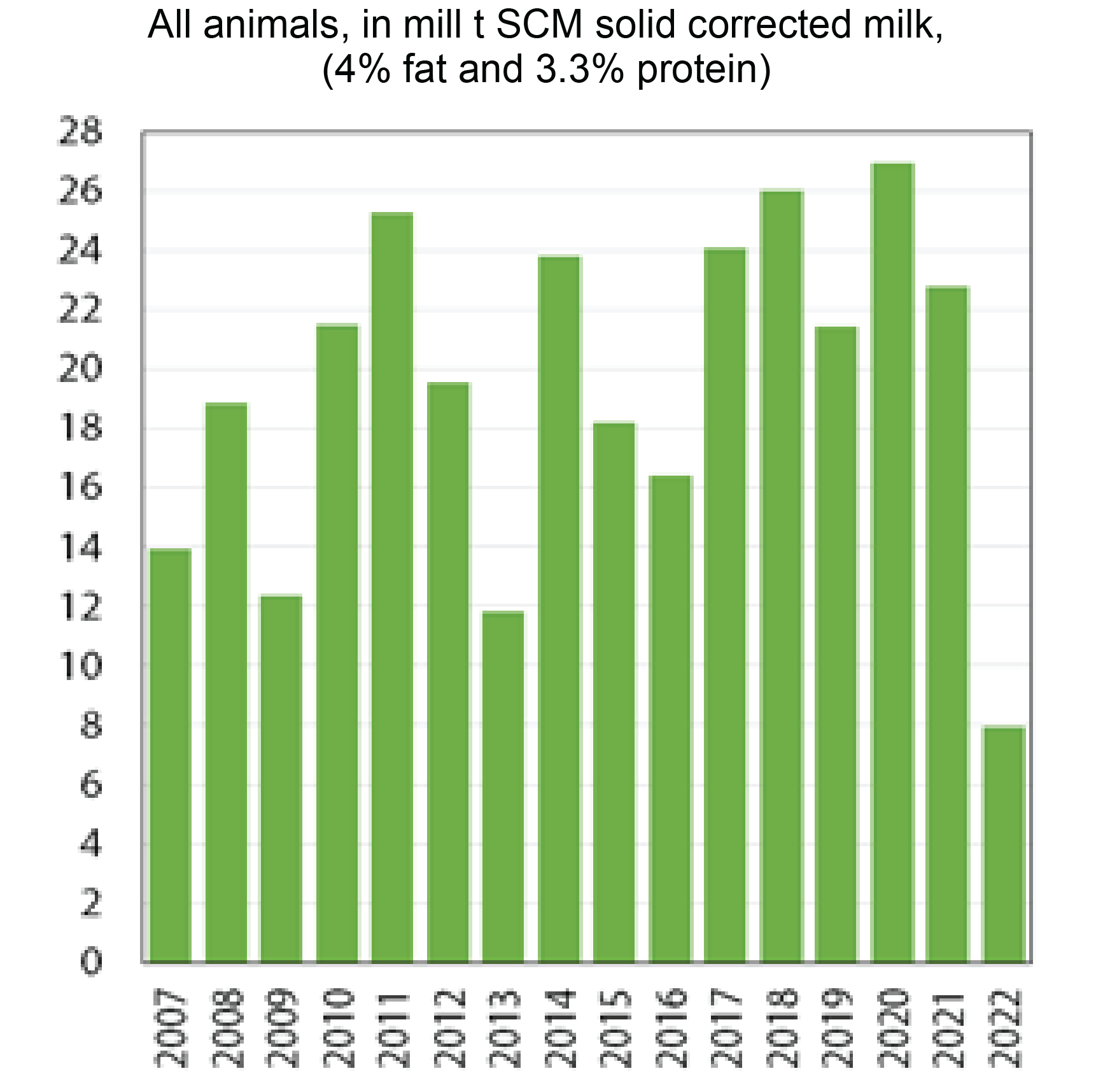

The lowest milk production growth of the last two decades monitored in 2022

In terms of global milk production, 2022 brought an extraordinarily low milk supply growth of +0.8%, unlike the long-term average (2001-2021) of 2.3 %. Not only inflation impacted the whole sector and hence the producers, but also adverse weather events turned out to be a major challenge in many regions of the world.

In 2022, India remained the largest producer. However, despite its 10 years’ average growth rate of 5.2%, it showed only a 2% growth in 2022, mainly due to its challenge with the Lumpy Skin Disease and adverse weather events. EU-27, if it was a country would be ranked second, showing a milk production decline by -0.3%, the first decline since 2009. Again, this was mainly driven by struggles with adverse weather conditions and high input costs for the farmers. New Zealand declined by -3.7% not only due to global challenges, but also by strong rainfall and lack of sun which negatively affected pasture growth. Differently to these major exporters, The United States still grew by 1.6% by improving in yield and good farm margins. Extreme weather events also hampered milk production growth in Latin America (-2.3%), in the same way as for example in South Africa (-2.6%).

Get your own copy of the IFCN Dairy Report 2023

Per capita consumption is declining due to accessibility and affordability of milk

In the same way as milk production growth, total demand increased by merely +0.8% in 2022. Analysing this further, it can be observed that while milk demand via population growth increased by +1%, per capita consumption decreased by -0.2%.

Since 1998, no decline in per capita consumption has been measured by IFCN and therefore questions were raised about this exceptional event in 2022. Two major reasons were identified to explain this development. Firstly, globally monitored high inflation rates negatively affected the affordability of food and secondly as mentioned above, there was a lower availability of milk globally.

Global milk production changes

Imports from China declined by -24%. Main reasons were strong domestic milk production and reduced consumption due to lockdown restrictions in accordance with the Zero Covid Policy but also a slowdown in GDP growth. As a consequence, milk demand decreased by 2.6% at country level, the first drop in milk consumption since 2014 in China.

Milk price development in 2022

In 2022, the world milk price reached a record high of 63.3 USD/100 kg SCM in April before steeply declining again and averaging 53.3 USD/100kg SCM in 2022. The continuous increase of feed, fertilizer, and energy prices as well as the low availability of milk led to high levels of commodity prices.

Good farm economics and the impact of exchange rates

The high IFCN World Milk Price Indicator in 2022 was transmitted to the national milk prices in most countries. Likewise, the cost of milk production grew in most countries. In the course of last year, especially feed, fertiliser and, in some parts of the world, also energy prices kept rising. As the production costs increased at a lower rate than the milk price, farmers in all parts of the world enjoyed a positive entrepreneur’s profit, giving the farmers a feeling of relief from the economic constraints of the previous years. At an international level, data were presented in USD and the dollar gained strength in many countries across the globe, e.g. local currencies showing depreciation rates of >10% in many countries in Europe and Oceania. This development of the exchange rate balanced the rise in costs and therefore, farms turned out to be internationally more competitive than the national economic situation might have suggested.

Download the pdf version of this article

Looking ahead to 2023

Within the first months of 2023, the decreasing trend in milk price has continued, but still maintaining a high level. On one side, this development was due to milk production recovery and higher commodity availability that pulled prices down. Moreover, inflationary pressure and economic anxiety weakened demand.

At the time of writing, supply growth in 2023 appears to be positive, but not yet abundant enough to compensate for last year’s decline. Therefore, a recovery of the milk price is expected by the end of 2023.

The wave of inflation does not only influence consumer decision-making, but also causes farmers to cut back on investments. The rapid increase in prices of fertilisers, energy, wages, construction materials, etc. puts pressure on the profit margins of dairy farms.

For the sector to recover, it will be important that farmers’ input costs no longer use up the additional farm income from the still quite favourable milk price.

IFCN upcoming events

IFCN Dairy Forum 2023 – Visions for winning strategies in developing dairy markets

IFCN past events

IFCN Global Tech Mapping 2023