Global Milk Prices Ease on Expanding Supply

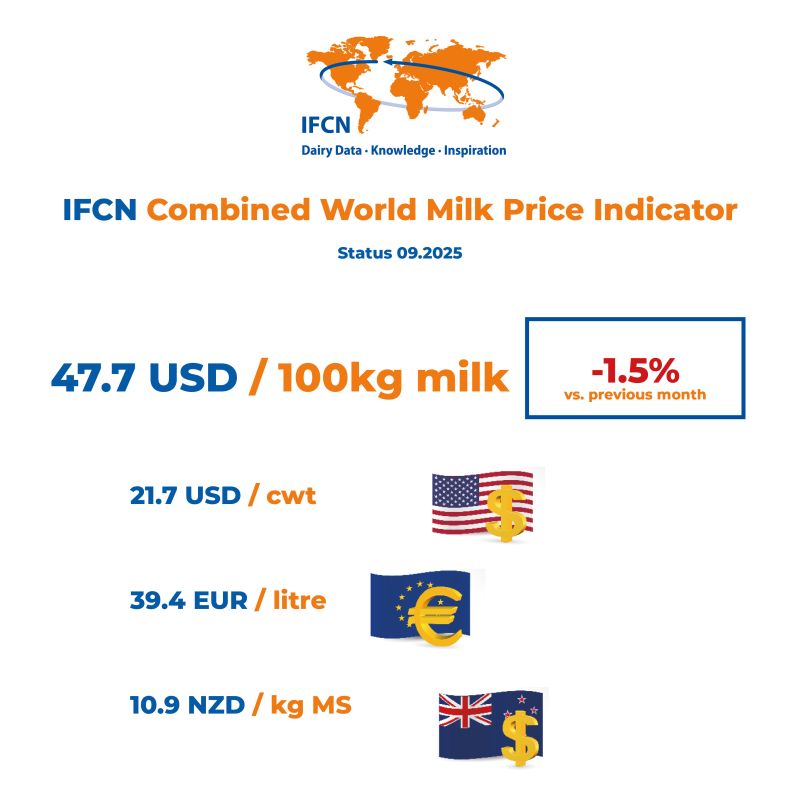

Global milk prices softened in September, reflecting sustained production growth across key regions. The IFCN World Milk Price Index declined 1.5% month-on-month, led by lower butter and skim milk powder (SMP) prices. In contrast, cheese markets strengthened, buoyed by resilient domestic and export demand.

Regional Drivers and Product Trends

- Butter: Prices fell under the weight of elevated milk supply and competitive U.S. export offers.

- Cheese: Prices climbed amid robust retail demand and stronger milk solids.

- SMP: Prices weakened as increased output in Oceania boosted global availability.

Expanding Milk Production

Production growth remains ahead of 2024 levels, supported by favourable weather conditions, high feed efficiency, and relatively strong farm margins. Expansion in North and South America is leading the trend, with the U.S. dairy industry registering exceptional component yields. The UK continues to perform strongly, while New Zealand’s seasonal outlook points toward further gains.

Market Outlook

The September decline signals a global market recalibration — with increased milk flows, stable consumption, and moderate price pressure across key commodities. Analysts view the dairy sector as fundamentally stable, with output growth expected to continue through late 2025 despite softer pricing dynamics.

IFCN upcoming dairy events

Events calendar

17

February

IFCN free public webinar | February 17, 2026 15:30 CET

Creating Value in Argentina's Dairy Supply Chain:

Opportunities & Threats Under Milei's Reforms

24-25

March

Dairy Outlook Workshop 2026 | 24th – 25th March 2026, Brussels

A New Era for European Dairy

Live Workshop in Belgium